Sweet Corn

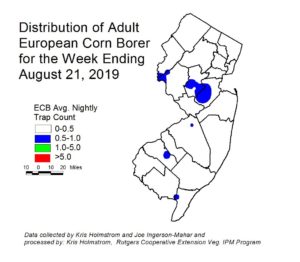

European corn borer (ECB) moth captures remain scattered and very low, and no map will appear in this addition. There are very few plantings not yet silking. Silk sprays for corn earworm (CEW) control will serve to manage ECB larvae as well. Reminder: Useful insecticides for worm control in the silk stage include spinosyns (including OMRI approved Entrust) IRAC Grp 5), and diamides such as Coragen (IRAC Grp 28) or materials such as Besiege which include the active ingredient in Coragen. Synthetic pyrethroids alone should NOT be used for corn earworm (CEW) protection on silking corn. Control with these materials is very inconsistent.

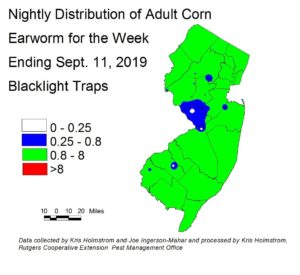

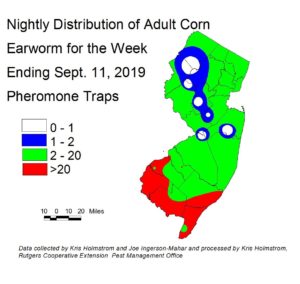

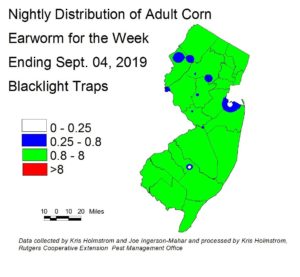

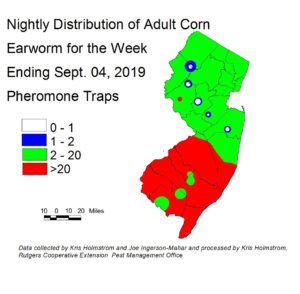

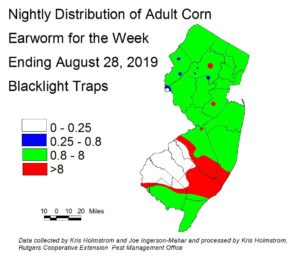

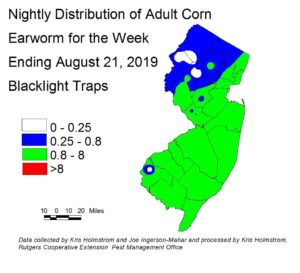

Corn earworm (CEW) moth catches have changed little in NJ this past week. Overall, CEW numbers represent a normal late summer population. While moth counts will decline somewhat with cool night temperatures, look for strong rebounds when nighttime temperatures exceed 60F. The green area on the blacklight map (left) represents a 3-day silk spray schedule zone. Blue and white areas within the overall green zone are outliers, and corn growers in or near those areas should also adhere to 3-day silk spray schedules. Economically damaging populations of this pest are present throughout the state, and all areas are at extreme risk of crop injury if strict silk spray schedules are not observed. Red areas on the on the pheromone trap map (below at right) indicate a 3-day silk

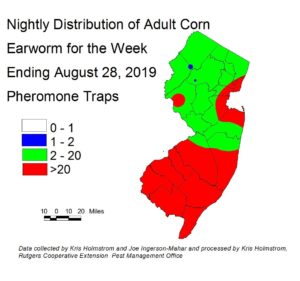

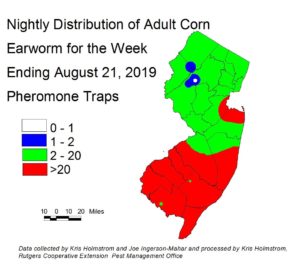

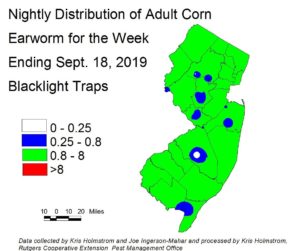

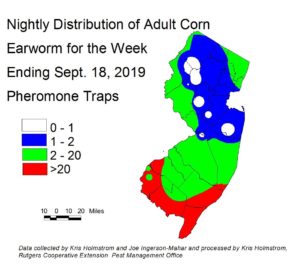

Corn earworm (CEW) moth catches have changed little in NJ this past week. Overall, CEW numbers represent a normal late summer population. While moth counts will decline somewhat with cool night temperatures, look for strong rebounds when nighttime temperatures exceed 60F. The green area on the blacklight map (left) represents a 3-day silk spray schedule zone. Blue and white areas within the overall green zone are outliers, and corn growers in or near those areas should also adhere to 3-day silk spray schedules. Economically damaging populations of this pest are present throughout the state, and all areas are at extreme risk of crop injury if strict silk spray schedules are not observed. Red areas on the on the pheromone trap map (below at right) indicate a 3-day silk  spray schedule, while green indicates a 4-5 day silk spray schedule. Currently, the black light network is indicating a more conservative spray regime statewide, than is the pheromone network. Taken together, blacklight and pheromone traps are indicating 3-day silk spray schedules throughout the state. There are far fewer CEW pheromone traps than blacklights, and the resulting map has much broader color bands as a result. It should also be noted that the pheromone traps are much more sensitive than blacklights. Therefore, the number of moths caught in pheromone traps required to generate a specific spray interval is much higher than the number caught in blacklight traps. It must be stressed that there is high variability in these catches, and growers should consult with their IPM practitioner on recommended spray schedules.

spray schedule, while green indicates a 4-5 day silk spray schedule. Currently, the black light network is indicating a more conservative spray regime statewide, than is the pheromone network. Taken together, blacklight and pheromone traps are indicating 3-day silk spray schedules throughout the state. There are far fewer CEW pheromone traps than blacklights, and the resulting map has much broader color bands as a result. It should also be noted that the pheromone traps are much more sensitive than blacklights. Therefore, the number of moths caught in pheromone traps required to generate a specific spray interval is much higher than the number caught in blacklight traps. It must be stressed that there is high variability in these catches, and growers should consult with their IPM practitioner on recommended spray schedules.